MUTUAL FUND

What is Benefit of Investing through Mutual Fund?

The Mutual Fund companies (MFCO’S) appoint highly Professional, and Qualified Personnel, who can afford to pay high salaries to them as they are managing large amount of funds. They have up to date market information, and more over they are constantly interacting with the companies about their future Plans and prospects of their product wherein the MF co desires to invest. The Mutual Fund House(s) Strategic approach and focus is fundamentally to select quality stocks that are well researched and then investments are made by them in select companies who have the potential to outperform in the long run thus to achieve suitable diversification.

DIVERSIFICATION

The Mutual Fund co.’s make diversifications as per their offer Document/objectives and make investments to maximize their profits. The unit holders stand to benefit with this technics’ adopted.

LOW COST

Since The Mutual Fund companies are making large amount of investments the charges levied by the Broking companies are competitive. Ultimately the small investors stand to gain.

FLEXIBILITY AND CONVENIENCE

The small investors stand to benefit as a small percentage of units in each investment made by Mutual Fund companies in different sectors thus achieve benefits of diversification.

LIQUIDITY

The investors enjoy the benefit of liquidity i.e. they can withdraw (Redeem) their units as per their needs. Thus funds will be in the hands of investors as and when they need.

APPRECIATION OF INVESTMENT

The investor stands to gain appreciation of units by virtue of increase in per unit rise in its NAV (Net Asset Value) over a period of time.

TRANSPAENCY

At periodical intervals the Mutual Fund co(s) give details of investments made by them to the investor(s) in each scheme. The details of investments made in the companies is available on their website (list of companies with their website address is listed at “USEFUL LINKS”) Moreover the Government is keeping close watch on the Mutual Fund Companies through SEBI (Securities and Exchange Board of India.)

TYPES OF MUTUAL FUND

Based on each individual’s requirement the fund house have various Schemes to suit their requirement depending upon their time Horizon and risk appetite.

EQUITY FUND

The amounts invested by Mutual Fund Companies in Equity Shares are called Equity Funds. The purpose of investing in Equity Fund is aimed for growth in its share value which is best suited to MF investors for long term appreciation of their investments. They are best suitable to the investors who invest at their young age which helps them for creation of sizable corpus(capital) for use during their sunset years .There are different types of Equity Funds such as Diversified Equity Funds, specific sector Funds such as Banking, FMCG, IT, Pharma etc. and Index Fund.

A well Informed Investor who desirous to meet his long term goals he needs to invest in such products so that his Investment returns will out perform Inflation. To make it more simple if the investor’s investment generate a return of 10 % and the prevailing inflation rate is 8 % then the real rate of Return is only 2 % which will not help him to achieve his desired Goals, on the contrary the real value of his investment will be reduced .The traditional products will not help the investor to beat inflation cost and build wealth (Capital / Corpus) .The study has proved that the investments made In the Equity and Equity related products will out perform the traditional saving products and will help the Investor to achieve his GOALS.

DIVERSIFIED FUNDS

The investment made through this scheme is aimed for investment through all sectors without any restriction, and the Mutual Fund companies are at their free will to make investment depending upon Market situation for optimum profits ultimately the investors stand to benefit.

SECTORS FUNDS

The object of Investment in this particular scheme is aimed to make investment in a particular sector as per MF Company’s offer document. The investor needs to keep watch on the performance of the Sector to help him to exit at peak level.INDEX FUND

The MF companies make investment in such companies’ shares which move as per index performance such as BSE/NSE. The value of NAV of MF companies move as per the movement of Index.

TAX SAVING FUNDS

The tax saving out of taxable income is most important which will help the tax payer to generate wealth in long run, moreover it will be most useful during taxpayers sunset years .The Investments made by investors in this scheme popularly known as ELSS (Equity Linked Saving Scheme) is primarily, our Central Government, is offeringTax Benefit under Income Tax Act under Section80 C and a tax payer can save Income Tax up to RS: 46,350/ in a financial year. There is no upper Limit/restriction for investment under this scheme which will help investor to reduce his taxable income by RS. 1,50,000 / . This we will illustrate by a following chart.

(I) Gross Total Income / Total Salary in a Financial Year (II) Investment Made in a Mutual Fund’s Tax Saving Product (Called ELSS) (III) Taxable Income (I-II) (IV) Income Tax Saved Under Section 80 C (Which Includes Education cess @ 3 % )

MOTHLY INVESTMENT IN ELSS

An Investor is having advantage of saving under this scheme on a monthly basis by choosing SIP (Systematic Investment Plan) rout which will avert last minute rush in the month Of March Every Year to arrange funds to save tax under this scheme. They can make investment from a monthly sum of RS. 500 / to any higher amount in a predetermined calculation and save in this scheme to avail exemption under Income Tax Act under section 80 C.

DEBT FUND/ FIXED INCOME SCHEME

The funds invested by MF companies in this scheme is predominately the Investments in Government securities, highly rated corporate Bonds with their track records for timely payments on due dates, Debentures, Commercial Papers,and any other secured Money market Instruments. The investment made by Investors in this scheme are not willing to take stock market risk and desire to have steady income. They are best suitable for senior citizens.

GILT FUNDS

The MF companies make investments in Central and State Government Securities which are best suitable to the investors who are avers to take stock market risk. The Government Securities have no default risk.

BALANCE FUND

The MF companies make investment in both equity and as well in Fixed Income Security Instrument(s) which provide regular income for the growth of investor’s investment. The scheme is best suitable to investors who are willing to take moderate risk more particularly suitable for senior citizens for regular income.

METHODS OF INVESTMENT

(1) Lump sum

(2) SIP

LUMP SUM

In Lump sum investment, the Middle Age/ senior citizen person have choice to invest in a secured low risk scheme to earn regular income at monthly interval.

SIP

The investment made through The Systematic Investment plan (SIP) has been proved profitable to the investor, who has the choice to make small investment regularly every month depending upon his income. The SIP can be from Rs.500/ to any large amount. SIP is like a Recurring Deposit Scheme of a Bank where in on a fixed date the Investors amount is deducted from his saving Bank account through ECS in a designated Scheme. The Investor has a great advantage of market fluctuation which helps him in Rupee cost averaging.

In SIP the Investors monthly investment remain constant .When market is on high side the investor get small number of units where as when market is on low side they stand to Gain more number of units thus SIP rout helps for rupee cost averaging. The SIP when commenced at a young age will help investor for wealth creation. In this scheme the investor need not time the market for investment, but make regular investment through ECS for long term for creation of capital.

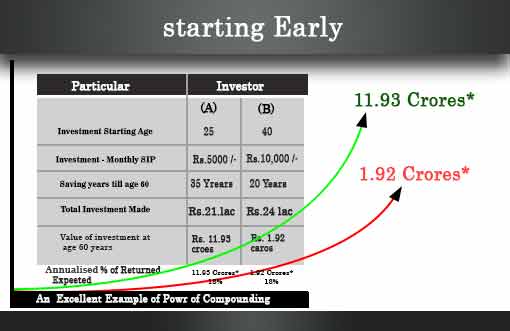

Here under we will explain how two investor(s), one who start investing at age of 25 and other at age of 40 make investment in Mutual Fund scheme through SIP up to their age of 60 years. How large difference is seen in wealth creation if they start saving regularly at early stage of their career.

(1)Monthly SIP Amount. Investor (A) Rs.5,000/,Investor (B) Rs.10,000/

(2)Investment up to age of 60 years

(3)Average Rate of Return 18% p.a.

WHY YOU NEED A FINANCIAL CONSULTANT (ADVISOR)?

A Financial Advisor will give investor following services.

(1) Professional advice to achieve financial goal.

(2) A financial plan will be prepared without bringing strain on your purse.

(3) Apprise you details about each financial product and its effect on your goal

(4) To review financial plan and guide you at your request.

(5) He will suggest you to commence saving at an early stage of life in the

financial products for a visible compounding effect.

(6) He will save your avoidable strain and valuable time in studying various products

to help you to concentrate in your field/Job

APPEAL TO INDUSTRIES / CORPORATE HOUSES

We appeal to Industrialists and Corporate Houses, in the invent, if they visit our website ,then please advise your Personnel Manager to get in touch with us to allow us to present our power point Presentation on “Benefits Of Investments “ in Insurance /Mutual Fund as a part of “Investor Awareness Program “ for the benefit of their Officers ,Employees, Workers keeping following Points in mind.

(1)Presently the Investment in Mutual Fund Industry is around 2 to 3 percentage of the Total investable amount due to lack of knowledge / Information.

(2) The returns in Mutual Funds are huge in long term Horizon for Wealth creation.

(3) When Foreign Portfolio Investors (FPI)/ Foreign Institutional Investors (FII) have made huge Investments in Equities and Bond Market and earned sizable Profits in our country in Equities/ Debt Funds. For details, please visit website of CDSL listed at (USEFUL LINKS), it shows that they have full faith In our country’s potential and safety of their funds, but our own country men are shay of making Investments even through Mutual Fund companies scheme(s) ,some of them have proved excellent results with track record.

(4) People need to make beginning of investment at their early stage of life for wealth creation.